OLUWATOBI ODEYINKA writes on the remarkable achievements of Nigeria’s instant payment system, as well as the pressing challenges that Nigerians face when making digital payments.

Mrs Olufemi, who sells Cement in Lagos recalls how she used to take huge cash to the bank about 10-15 years ago. “Now I transfer millions through my bank app and smaller amounts through USSD, and my suppliers confirm payment almost instantly.

About a decade ago financial transactions used to be slow, stressful, and volatile. If you wanted to pay for a good or service or send money to a loved one, you would have to pay with cash or take the money to the bank to deposit into the other party’s account. Businesses in this period witnessed failed or delayed transactions and a prevalence of armed robbery as citizens relied heavily on cash.

Today, the narrative has changed; interbank transfers are swift, convenient, and safe, thanks to the Nigeria Inter-Bank Settlement System (NIBSS). Nigeria currently has one of the fastest payment systems in the world and the African giant leads the continent in instant and digital payments.

Encouraged by the 2011 cashless policy of the Central Bank of Nigeria, NIBSS now facilitates in-time, daily clearing and settlement of funds transferred between different banks, removing bottlenecks and guaranteeing digital security. This is done through an initiative known as the NIBSS Instant Payment (NIP).

Since it was introduced in 2011, Nigerian banks have integrated the NIP into various banking channels including Internet banking, mobile apps, Unstructured Supplementary Service Data (USSD), and Point of Sales (POS) terminals.

The account-based NIP has proven to be an essential component of Nigeria’s payment infrastructure, facilitating instant P2P and P2B payments through electronic transfers and payments.

Data mined from the NIBSS official website shows a steady rise in the adoption of digital transactions over the years. NIP value has risen from N10.2 trillion in January 2020 to N89.5 trillion in July 2024. The volume of electronic transactions through NIP has also maintained an impressive upward curve rising from 111.35 million transactions in January 2020 to 968.59 million in December 2023.

Today, NIBSS is equipped with advanced technological infrastructure and robust security systems, enabling it to deliver world-class payment and settlement services. Additionally, it plays a key role in minimizing operational and credit risks during funds transfers between financial institutions.

…But Operational Challenges Persist

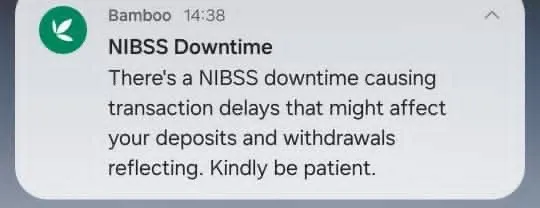

However, the system is notorious for operational challenges, especially in the form of downtimes which delay electronic transfers of money. The message below is one that many Nigerians have received at one time or another.

The announcement of NIBSS downtime precipitates frustration for Nigerians when making digital transactions.

Mrs Ibukun Emiola made a transfer of N84,000 last month, but it was delayed for about five days. “I went to the bank to do the N84k transaction. It didn’t drop until I had to go back the third day, then I was asked to wait for 48 hours again, after which it dropped,” she said.

Mrs Emiola has another transaction that has been pending for weeks. “I used the POS to pay for fuel, my card was declined but my account was debited. It’s been over two weeks and it has not been reversed, even though I have sent multiple emails to the bank with no response.

Many bank users who spoke to this reporter complained that their experiences using USSD and bank apps for transfers are “occasionally poor”

Oke Oluwasegun, Michael Babatunde, and Adebayo David, all residents in Abeokuta, say their experiences using their bank apps for transfers are “Occasionally poor”.