Nigeria’s digital public infrastructure, particularly its digital payments layer, has expanded access to financial services for millions of citizens previously excluded from the formal banking system.

At the centre of this transformation are interoperable payment rails such as Unstructured Supplementary Service Data (USSD) and the Nigeria Inter-Bank Settlement System (NIBSS), which underpin the country’s growing fintech ecosystem.

The introduction of the cashless policy by the Central Bank of Nigeria (CBN), accelerated the adoption of digital payment systems across sectors. For women traders and artisans, many of whom operate outside formal regulatory and banking structures, this shift has reshaped how they save, plan, and access credit.

From Ajo to Apps: A Shift In Informal Savings

Before the introduction of digital payment platforms gained widespread adoption around 2012, most market traders and artisans relied largely on daily or weekly thrift collectors, popularly known as Ajo or Esusu, to save money. These informal systems, while culturally entrenched, often depended on trust and physical cash handling, leaving savers vulnerable to loss, delays, or fraud.

More than a decade later, fintech wallets and point-of-sale (POS) terminals are helping to plug the informal sector into Nigeria’s digital financial infrastructure. This has allowed women traders and artisans to save small amounts regularly, build transaction histories, and access financial services without visiting a bank branch. Bilkis Abdulraheem Lawal spoke with traders and artisans who now save money and access credit through fintech wallets.

One of them, Olatunbosun Temitope a trader at Iyana Ipaja Area of Lagos state, said she prefers saving through her Opay or Palmpay wallet because she considers them more reliable than traditional thrift collectors.

“I trust fintech wallets more than Ajo collectors. They also give me the opportunity to borrow money whenever I need it, and that has helped my business over the years,” she said.

Similarly, another trader, Elizabeth Sari , said she prefers using an Opay wallet because of concerns about the reliability of some thrift collectors.

“Some thrift collectors are not trustworthy, and some will not give you your money when you need it. With Opay, there are good security policies. Even if your account is locked as a fixed account and you want to withdraw before the due date, you can still access your money after answering questions on why you need it. With Ajo, you have to wait until the end of the month or year,” she explained.

For artisans, fintech wallets also provide flexibility and automation that traditional savings models lack.

Segun Adebanjo, an artisan, said he had largely abandoned conventional commercial banks in favour of fintech wallets because of their convenience.

“I save money without stepping out of my comfort zone. I particularly like the savings plan that allows me to set a target. If I have a commitment, I can decide to save daily or weekly, and I will not have access to the money until the agreed date, whether three or six months. This has helped me meet my financial needs with ease,” he said.

A tailor, Mary Kodjo, said she saves N4,000 every two days and N10,000 every Sunday through a fintech wallet.

“I prefer fintech wallets to Ajo because saving is flexible. With Ajo, you must not miss a contribution date, or they will deduct your money or remove you entirely. I have been saving this way for three years without regret, and it has helped me grow my fashion business,” she said.

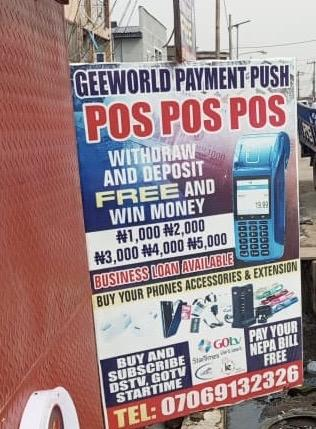

POS Operators As Street-Level DPI Interface

Point-of-sale operators have become critical intermediaries in Nigeria’s digital payments ecosystem, serving as access points to the country’s financial infrastructure for cash-based communities. A point-of-sale (POS) operator in Oshodi Market, Lagos State, Akinleye Mayowa, who runs G-World Technology, said many women traders make daily deposits into their bank accounts and digital wallets. According to him, “a lot of market women deposit money daily in their accounts and wallets,” but the recently introduced tax law has created panic among Nigerians, including women traders and artisans.

He explained that the development has slightly reduced deposits, as “most people now prefer to keep their cash to avoid deductions from their savings accounts or wallets.”

The Federal Government implemented its “new tax law,” which refers to four harmonised tax reform Acts signed into law in June 2025.

The Acts overhaul the country’s tax system with the aim of simplifying compliance, expanding the tax base, and boosting revenue.

However, many Nigerians, particularly at the grassroots, do not fully understand how the new tax regime works. This lack of clarity has fueled speculation and rumours about how the government may deduct money from citizens when they carry out electronic transactions.

Mayowa also identified transaction inconsistencies as a major challenge, noting that “sometimes when we send money, it does not get to the destination account,” a situation that often puts operators under pressure from customers who demand proof of payment or even court orders before the money can be reversed.

He urged the government and relevant stakeholders in the banking sector to simplify the process of reversing erroneous transactions saying the current system “is creating a gap between the banks and the residents.”

Another POS operator, Musbau Ibrahim, said women traders deposit money regularly, which supports his business.

“I collect cash from them and use it to pay other customers who want to withdraw,” he said.

While acknowledging challenges such as receiving counterfeit notes from some customers, which can negatively affect the business, Ibrahim described POS operations as “a good business that pays my bills and also helps market women save for the future.”

Evolution of Digital Payment Systems in Nigeria

Mobile money services were introduced in Nigeria around 2009, following the Central Bank of Nigeria’s release of the Guidelines on Mobile Money Services. The rollout (USSD – based banking services around 2012 led by banks such as Guaranty Trust Bank, expanded access to digital financial transactions for retail users.

These developments laid the foundation for Nigeria’s digital payment layer, one of the core components of DPI, enabling interoperability between banks, fintech and mobile networks. This infrastructure enabled customers, particularly women traders and artisans, to save small amounts regularly, participate in the formal financial system, improve financial planning and resilience, reduce cash-handling and theft risks, and build digital transaction histories that can unlock access to credit.

Nigeria’s fintech ecosystem is characterised by a mix of regional and international players, such as Opay, Palmpay, Moniepoint, Flutterwave, Paystack, Interswitch, Kuda Bank and Cowrywise, among others, operating on shared rails like USSD and NIBSS.

A 2024 report by Moniepoint Incorporated, in collaboration with the Federal Ministry of Industry, Trade and Investment and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), revealed that 39.5 per cent of informal sector businesses use digital banks for savings, while only 11 per cent rely on conventional banks.

Nigeria’s informal sector remains vast. According to the Director-General of SMEDAN, Charles Odili, about 40 million small businesses operate within the informal sector.

The report also noted that nine out of every ten working women in sub-Saharan Africa are employed in the informal economy, with women owning 37.1 per cent of businesses in the sector. This underscores the critical role of the informal economy in women’s economic empowerment in Nigeria and across Africa.

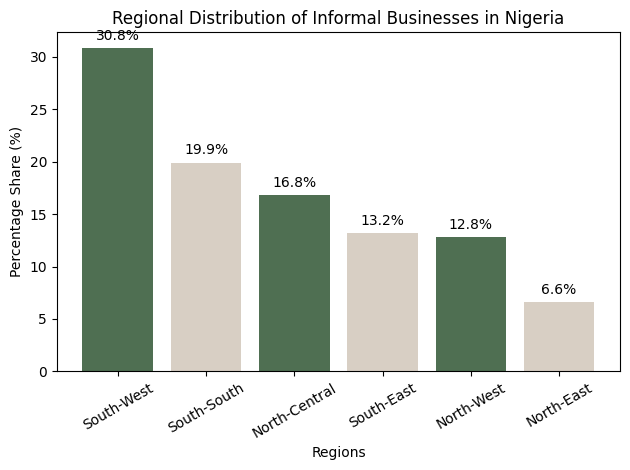

Regionally, the South-West accounts for the largest share of informal businesses at 30.8 per cent, with Lagos alone contributing 15.1 per cent. It is followed by the South-South at 19.9 per cent, North-Central at 16.8 per cent, South-East at 13.2 per cent, North-West at 12.8 per cent and North-East at 6.6 per cent.

Growth, scale, and systemic pressures

According to the Nigeria Payment Report 2025, developed by TC Insights in partnership with Zone, Nigeria continues to lead the continent in fintech adoption and investment, attracting 140 million dollars in the first half of 2024 alone. The country hosts over 200 fintech start-ups and processed one N1.56 quadrillion electronic payment transactions in the first half of 2024 alone.

Similarly, the Nigeria Fintech Map 2025, reported that Nigeria was home to more than 430 fintech companies as of February 2025, up from 255 recorded in January 2024.

Expert perspectives on Inclusion and Literacy

A financial expert, Professor Khadijat Yahaya of the Department of Accounting, University of Ilorin, and Coordinator of Women in Taxation in Kwara State, said fintech wallets are more convenient for traders because they are faster and save time.

“They eliminate the financial burden of transporting cash and queuing in banks just to carry out transactions,” she said.

Professor Yahaya added that access to credit remains one of the most significant benefits of digital payment systems, but warned that digital literacy gaps could limit inclusion.

“Some people cannot even recite their phone numbers, which often serve as their account numbers,” she said.

She called for sustained public enlightenment to deepen financial inclusion.

Experts argue that digital payment systems supported by strong governance, public awareness, and reliable infrastructure, can serve as an inclusive form of banking for Nigeria’s informal economy. They urged government and relevant stakeholders to enlighten the populace especially on the newly introduced Tax Law and strengthen Nigeria’s digital public infrastructure to ensure broader inclusion of informal sector participants.

This report is produced under the DPI Africa Journalism Fellowship Programme of the Media Foundation for West Africa and Co-Develop.